Financial results

Financial results

FY 2025 release on February 19th, 2026

2024 Integrated report

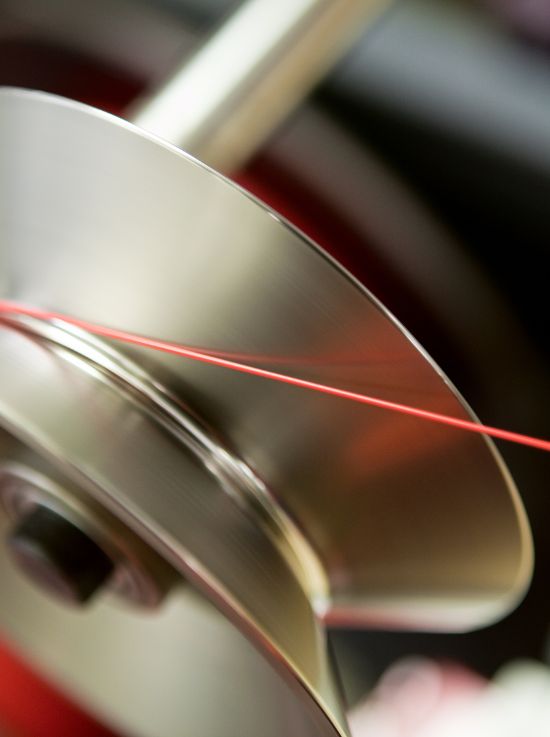

Discover Nexans’ 2024 Integrated Report, emphasizing our role as a leading global player in sustainable electrification. This report highlights our strong commitment to CSR, strategic initiatives, and ambitious financial objectives. Find out how Nexans is poised to seize megatrends and lead the energy transition, with a focus on innovation and low-carbon products and services.

Download the report (PDF – 2MO)