By 2024, Nexans aims to become a pure Electrification player, with a resilient and focused portfolio, characterized by high profitability and strong cash generation. The Group will rotate its portfolio towards electrification through M&A and divestments, materially improve existing electrification activities profitability and moderately grow in volume from €6bn to between €6 to 7 billion by 2024 while stepping up profitability.

The new Nexans model is powering performance and resilience

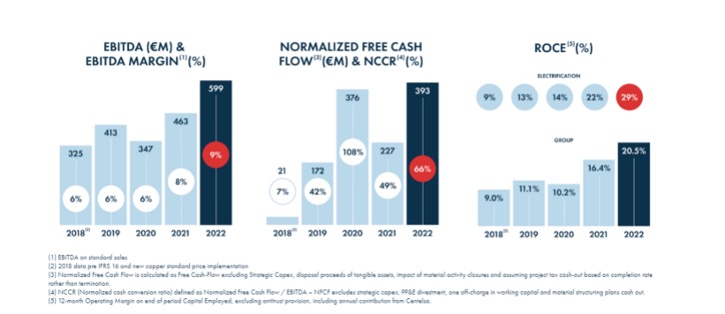

Since 2018, Nexans has undertaken an in-depth transformation, building a leaner, more customer centric and profitable Group. The successful deployment of the New Nexans operating model, has enabled the Group to unlock value and set strong financial footing.

2022: Record year for strong profitable growth

- All time high EDITDA, Normalized FCF and ROCE performance

- Continued focus on growth driven by value and successful transformation platform

- Enhanced liquidity and solid balance sheet maintained

- Increased shareholder return with a proposed dividend return of €2.10 per share.

S&P’s decision to upgrade Nexans’ credit rating outlook reflects the largely demonstrated transformation of the Group since 2019 and our value growth focus. It also underlines Nexans’ resilience and capacity to strengthen its balance sheet in line with its Electrification Pure Player strategic roadmap.

Jean-Christophe Juillard

Group Deputy CEO and Chief Financial Officer,