- First-quarter 2025 standard sales of €1,815.4 million, up +4.1% organically year-on-year:

- Electrification businesses were up +6.8% organically, with double digit organic growth in PWR-Transmission segment. PWR-Grid and PWR-Connect remained well-oriented

- Record adjusted backlog for PWR-Transmission, mainly subsea-driven, at €8.1 billion, up +9.7% compared to €7.4 billion at end of December 2024

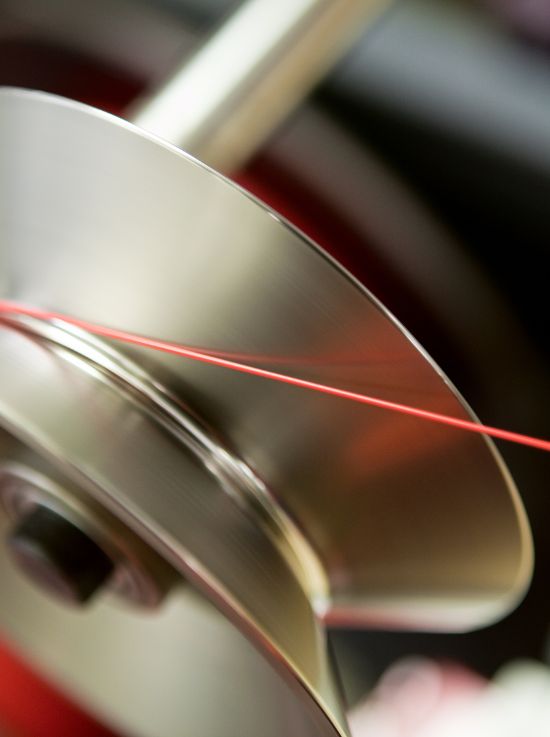

- Major framework agreement, valued at more than €1 billion, was secured with RTE in March 2025 for the design, manufacturing, and supply of HVDC cables, which will be used to connect offshore wind farms to the French transmission network

- On April 29, 2025 Nexans has been awarded a contract by Interconnect Malta (ICM) to deliver high-voltage subsea cable for Malta’s second interconnector. The cables for this project will be produced at Nexans’ facility in Charleston, USA

- Global electrification pure player profile further strengthened

- Exclusive negotiations with Latour Capital for the sale of Lynxeo, closing expected in Q3 2025

- Integration of La Triveneta Cavi well on track, delivering expected synergies

- Full-year 2025 guidance confirmed

-

- Adjusted EBITDA of between €770 and 850 million (excluding future changes of scope)

- Free Cash Flow of between €225 and 325 million (excluding future changes of scope)

-

- Considering the very limited presence and exposure of the Group in the US, no material impacts have been identified in relation to US tariffs as announced on April 2, 2025. The Group monitors the evolving situation closely

Nexans, a global leader in the design and manufacturing of cable systems to power the world, announces its financial information for the first-quarter of 2025.

Commenting on the Group’s first-quarter highlights, Christopher Guérin, Nexans’ Chief Executive Officer, said:

« Our first-quarter results demonstrate the structural strength and lasting impact of Nexans’ strategic transformation. Driven by our electrification businesses achieving robust organic growth of +6.8%, this performance reflects our vision and excellence in operational execution.

The strategic divestment of Lynxeo1 reinforces our commitment to becoming a pure player in electrification, sharpening our strategic focus and enhancing our capability to deliver integrated, high-value solutions. We maintain a disciplined approach to external growth, actively pursuing targeted M&A opportunities precisely aligned with our core mission and enhancing sustainable long-term value.

At Nexans, performance is the result of deep structural improvements. The rigorous implementation of our SHIFT transformation program continues to unlock substantial value, fostering resilience and agility that will sustain our business through even the most challenging market conditions.

2025 marks a pivotal year for Nexans. Our clearly defined strategy, robust business model as a pure player of electrification, and unwavering commitment to lasting value creation continue to drive results benefiting all stakeholders.

Despite ongoing global economic and geopolitical uncertainties, Nexans confidently reaffirms its 2025 guidance. »

1 Subject to customary approvals

Download the full documents

First-quarter 2025 financial information presentation

Download the report (PDF – 5MO)Nexans will publish its first quarter 2025 financial information on Wednesday, April 30th, 2025 at 7:00am CEST. The press release and presentation will be available on our website: www.nexans.com.

Christopher Guérin, CEO, and Jean-Christophe Juillard, Deputy CEO & CFO, will host an audio webcast in English starting at 9:00am CEST on April 30th, 2025. Please find the access details:

Webcast link

https://channel.royalcast.com/landingpage/nexans/20250430_1/

Audio dial-in

We suggest connecting 5-10 minutes prior to start time of the conference call.

- International switchboard: +44 (0) 33 0551 0200

- France: +33 (0) 1 70 37 71 66

- United Kingdom: +44 (0) 33 0551 0200

- United States: +1 786 697 3501

- Spain : +34 91 787 0777

- Italy : +39 06 83360400

- Switzerland : +41 43 456 9986

Confirmation code: Nexans

Replay

A replay will be available on our website after the conference.

Full-year 2024 earnings presentation

Download the report (PDF – 6MO)- 2024 standard sales of €7.1 billion (current sales of €8.5 billion), up +8.7% on a reported basis and +5.1% organically

- Acceleration in Electrification businesses, up +13.0% organically in 2024, reflecting early-bird investment and unabated focus on value-added solutions

- Q4 2024 standard sales of €1.9 billion, up +8.3% organically driven by all businesses

- A performance-driven journey beyond 2024 objectives and “Winds of Change” 2021-2024 Capital Markets Day targets:

- All-time high adjusted EBITDA of €804 million, up +21.0% year-on-year, and adjusted EBITDA margin at 11.4%

- Outstanding Normalized free cash flow at €454 million and 56% normalized cash conversion

- Outperformance of ROCE in Electrification businesses at 26.3%

- Record subsea-driven PWR-Transmission adjusted backlog standing at €7.4 billion

- Successful deployment of the Electrification Pure Player strategy: Completion of the La Triveneta Cavi acquisition, divestment of AmerCable early 2025, and business separation of Lynxeo within the Non-electrification business

- Net income at €283 million, up +27% versus 2023

- Strong balance sheet: net debt at €681 million and 0.85x leverage ratio

- Attractive return to shareholders: proposed dividend for 2024 of €2.60 per share, up +13%

- Initiation of 2025-2028 strategic roadmap “Sparking Electrification with Tech solutions” with a new Executive Committee and structure to drive the next chapter forward

- Full-year 2025 guidance announced

- Adjusted EBITDA of between €770 and 850 million

- Free Cash Flow of between €225 and 325 million

Today, Nexans, a global leader in the design and manufacturing of cable systems to power the world, published its financial statements for the fiscal year 2024, as approved by the Board of Directors at its meeting on February 18, 2025 chaired by Jean Mouton. Commenting on the Group’s performance, Christopher Guérin, Nexans’ Chief Executive Officer, said:

“In 2024, Nexans once again demonstrated its ability to deliver profitable and sustainable performance in a dynamic market environment. The Group set a new financial record, underscoring the success of its structural transformation and long-term strategic execution.

2024 also marks the successful completion of our 2021-2024 equity story “Winds of Change”, a period in which Nexans fundamentally transformed into a pure player in electrification. As we move to our next chapter up to 2028 “Sparking Electrification with tech solutions”, we are building on this solid foundation with a renewed ambition: to accelerate our growth, drive innovation, and lead the energy transition with sustainable and high-value solutions. Our commitment remains unchanged—creating long-term value for all our stakeholders. “

Download the full documents

Nexans will publish its full-year 2024 earnings on Wednesday, February 19th, 2025 at 7:00am CET. The press release and presentation will be available on our website: www.nexans.com.

Christopher Guérin, CEO, and Jean-Christophe Juillard, Deputy CEO & CFO, will host an audio webcast in English starting at 9:00am CET on February 19th, 2025.

The live webcast will be available at this address: https://channel.royalcast.com/landingpage/nexans/20250219_1/

Sell-side analysts wishing to participate to the Q&A session at the end of the conference need to pre-register to receive connection details (dial-in numbers and passcode) by email.

Replay

A replay will be available on our website after the conference.

- Standard sales of €5,226 million in the first nine months of 2024, up +4.0% organically year on year and up +6.9% excluding Other activities

- Electrification businesses up +7.9% organically in the third quarter of 2024, reflecting early-bird strategic investments in the Generation & Transmission segment

- Strong adjusted backlog for Generation & Transmission, mainly subsea-driven, at €6.2 billion, up +19% compared to September 2023

- Expansion of manufacturing capacities through investments in onshore high-voltage and the production of low-carbon medium-voltage cables in France

- Strategic investment agreement in France to increase copper production and recycling capacity across Europe

- Ambitious Net-Zero 2050 climate targets approved by the Science Based Targets initiative

- Full-year 2024 guidance as updated in July 2024 confirmed

- Adjusted EBITDA of between €750 and 800 million

- Normalized Free Cash Flow of between €275 and 375 million

- Capital Markets Day to be held on November 13, 2024 in London and virtually, and US investors day on November 20, 2024 in New York City

Nexans, a global leader in the design and manufacturing of cable systems to power the world, announces its financial information for the first nine months of 2024. Commenting on the Group’s highlights, Christopher Guérin, Nexans’ Chief Executive Officer, said:

“The first nine months of 2024 have laid strong foundations for a robust financial year. Our Electrification businesses continue to drive growth, up +7.9% organically in the third quarter of 2024, showcasing that early strategic investments in Generation & Transmission are already yielding benefits.

In order to reinforce the positioning of our electrification strategy and keep pace with increasing electricity demand, we have decided to invest €90 million in onshore high-voltage capacity at our French and Belgian plants and €15 million in the production of low-carbon medium-voltage cables in France. In addition, Nexans continues to lead the way in the circular economy with a strategic investment agreement at the Lens plant, enabling the recycling of over 80,000 metric tons per year.

As we look ahead, I am confident that our continued focus on performance and strategic execution will drive long-term value for all stakeholders. At our upcoming Capital Markets Day in November, where we will further outline the initiatives that will shape Nexans’ trajectory in the years to come.”

Download the full documents

2024 First nine months financial information presentation

+4% organic growth driven by Electrification

Set for a robust year

Nexans will publish its third quarter 2024 financial information on Wednesday, October 30th, 2024 at 7:00am CET. The press release and presentation will be available on our website.

Christopher Guérin, CEO, and Jean-Christophe Juillard, Deputy CEO & CFO, will host an audio webcast in English starting at 9:45am CET on October 30th, 2024.

Please find the access details

Audio dial-in

We suggest connecting 5-10 minutes prior to start time of the conference call.

- International switchboard: +44 (0) 33 0551 0200

- France: +33 (0) 1 70 37 71 66

- United Kingdom: +44 (0) 33 0551 0200

- United States: +1 786 697 3501

Confirmation code: Nexans

Replay

A replay will be available on our website after the conference.

All our press releases

Read them all- H1 2024 standard sales of €3.5 billion (current sales of €4.2 billion), up +6.1% organically and Q2 2024 standard sales of €1.9 billion, up +9.4% organically

- Acceleration in Electrification businesses, up +14.1% organically in H1 2024, thanks to continued focus on value-added solutions

- Record adj. EBITDA of €412 million, up +16.4% year-on-year, adj. EBITDA margin at 11.6% up +96bps

- Robust Normalized FCF at €189 million, reflecting strong operational performance

- Balance sheet strengthened with two successful bond issuances

- Completion of the La Triveneta Cavi’s acquisition, enhancing European footprint and product offerings

- Halden subsea high-voltage plant’s extended capacity now operational, bolstering leadership in high-voltage solutions

- Full-year 2024 guidance upgraded, boosted by robust performance and integration of La Triveneta Cavi

- Adjusted EBITDA of between €750 and €800 million (€670 – €730 million previously)

- Normalized Free Cash Flow of between €275 and €375 million (€200 – €300 million previously)

- Capital Markets Day to be held on November 13, 2024 in London, and US investors day on November 20, 2024 in New York City.

Today, Nexans, a global leader in the design and manufacturing of cable systems to power the world, published its financial statements for the first-half of 2024, as approved by the Board of Directors at its meeting on July 23, 2024 chaired by Jean Mouton. Commenting on the Group’s performance, Christopher Guérin, Nexans’ Chief Executive Officer, said:

“The record profitability we have achieved in the first half of 2024 evidences our value growth focus and the strategic direction we have set for Nexans. We have seen robust growth across our Electrification segments, particularly in Generation & Transmission where the strategic expansion of our Halden plant in Norway has already begun to yield benefits.

The successful finalization of the acquisition of La Triveneta Cavi in Italy early June marks a significant milestone in our journey. This strategic move expands our Usage capabilities and reinforces our commitment to providing comprehensive, high-quality solutions to our customers globally.

Innovation continues to be a driving force behind our success, and our pioneering work, such as the superconducting fault current limiter developed with SNCF Réseau, exemplifies our dedication to pushing technological advancements.”