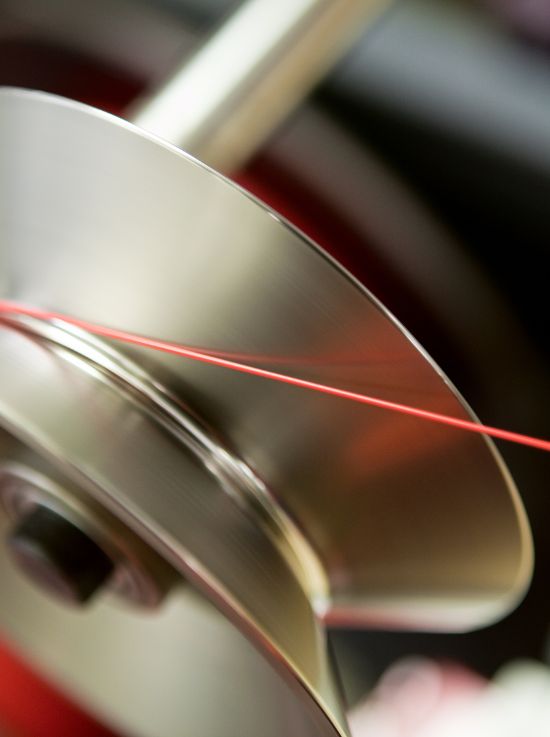

Untapped premiumization opportunity beyond cables

Value over volume has opened up our marketplace to new possibilities in innovation, digital and services.

Nexans is amplifying its R&D strategy in 3 core areas:

- customer experience (supply chain, services, smart products);

- digital solutions (industry 4.0, IoT);

- and sustainability (eco-design, low carbon and circularity).

Digital solutions are a growing part of Nexans portfolio. At Nexans, cable drums are tracked using IoT technology while our asset management solution helps grid operators get maximum return on their power network.