- First-quarter 2025 standard sales of €1,815.4 million, up +4.1% organically year-on-year:

- Electrification businesses were up +6.8% organically, with double digit organic growth in PWR-Transmission segment. PWR-Grid and PWR-Connect remained well-oriented

- Record adjusted backlog for PWR-Transmission, mainly subsea-driven, at €8.1 billion, up +9.7% compared to €7.4 billion at end of December 2024

- Major framework agreement, valued at more than €1 billion, was secured with RTE in March 2025 for the design, manufacturing, and supply of HVDC cables, which will be used to connect offshore wind farms to the French transmission network

- On April 29, 2025 Nexans has been awarded a contract by Interconnect Malta (ICM) to deliver high-voltage subsea cable for Malta’s second interconnector. The cables for this project will be produced at Nexans’ facility in Charleston, USA

- Global electrification pure player profile further strengthened

- Exclusive negotiations with Latour Capital for the sale of Lynxeo, closing expected in Q3 2025

- Integration of La Triveneta Cavi well on track, delivering expected synergies

- Full-year 2025 guidance confirmed

-

- Adjusted EBITDA of between €770 and 850 million (excluding future changes of scope)

- Free Cash Flow of between €225 and 325 million (excluding future changes of scope)

-

- Considering the very limited presence and exposure of the Group in the US, no material impacts have been identified in relation to US tariffs as announced on April 2, 2025. The Group monitors the evolving situation closely

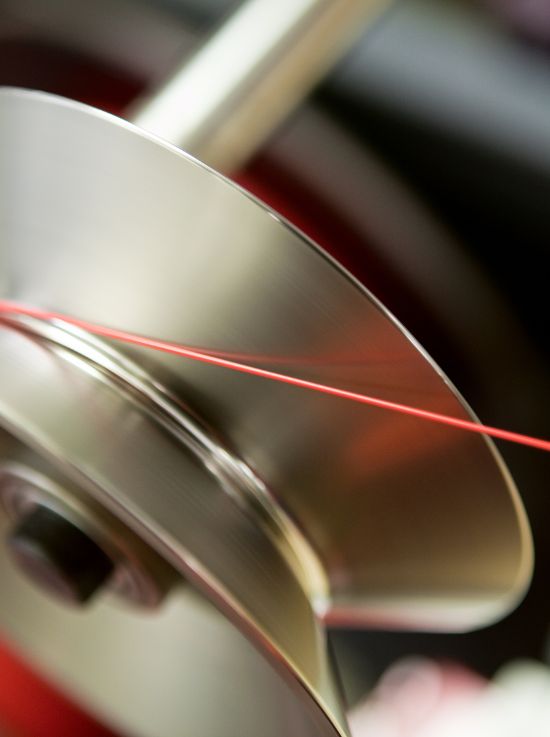

Nexans, a global leader in the design and manufacturing of cable systems to power the world, announces its financial information for the first-quarter of 2025.

Commenting on the Group’s first-quarter highlights, Christopher Guérin, Nexans’ Chief Executive Officer, said:

« Our first-quarter results demonstrate the structural strength and lasting impact of Nexans’ strategic transformation. Driven by our electrification businesses achieving robust organic growth of +6.8%, this performance reflects our vision and excellence in operational execution.

The strategic divestment of Lynxeo1 reinforces our commitment to becoming a pure player in electrification, sharpening our strategic focus and enhancing our capability to deliver integrated, high-value solutions. We maintain a disciplined approach to external growth, actively pursuing targeted M&A opportunities precisely aligned with our core mission and enhancing sustainable long-term value.

At Nexans, performance is the result of deep structural improvements. The rigorous implementation of our SHIFT transformation program continues to unlock substantial value, fostering resilience and agility that will sustain our business through even the most challenging market conditions.

2025 marks a pivotal year for Nexans. Our clearly defined strategy, robust business model as a pure player of electrification, and unwavering commitment to lasting value creation continue to drive results benefiting all stakeholders.

Despite ongoing global economic and geopolitical uncertainties, Nexans confidently reaffirms its 2025 guidance. »

1 Subject to customary approvals

Download the full documents

First-quarter 2025 financial information presentation

Download the report (PDF – 5MO)Nexans will publish its first quarter 2025 financial information on Wednesday, April 30th, 2025 at 7:00am CEST. The press release and presentation will be available on our website: www.nexans.com.

Christopher Guérin, CEO, and Jean-Christophe Juillard, Deputy CEO & CFO, will host an audio webcast in English starting at 9:00am CEST on April 30th, 2025. Please find the access details:

Webcast link

https://channel.royalcast.com/landingpage/nexans/20250430_1/

Audio dial-in

We suggest connecting 5-10 minutes prior to start time of the conference call.

- International switchboard: +44 (0) 33 0551 0200

- France: +33 (0) 1 70 37 71 66

- United Kingdom: +44 (0) 33 0551 0200

- United States: +1 786 697 3501

- Spain : +34 91 787 0777

- Italy : +39 06 83360400

- Switzerland : +41 43 456 9986

Confirmation code: Nexans

Replay

A replay will be available on our website after the conference.

- Nexans announces having entered into exclusive negotiations with Latour Capital for the sale of Lynxeo for €525 million, subject to customary approvals

- With the proposed transaction, Nexans would achieve major step on its strategy to become a Pure Electrification Player

Nexans announces today having entered into exclusive negotiations for the sale of its industrial cable division Lynxeo to Latour Capital, a France-based private equity fund, for an Enterprise Value of €525 million. This proposed transaction would mark Nexans’ exit from the specialty industrial cables activity in line with its strategy to refocus as a Pure Electrification Player.

Lynxeo is a powerhouse in specialty industrial cables and plays a key role as a fully integrated player, serving a diversified range of infrastructures industries in transportation, energy and automation. With a heritage of more than 100 years serving industrial champions, Lynxeo boasts a global manufacturing presence in Europe, Asia, and the United States of America, with 2,000 employees and annual standard sales of over €700 million.

This agreement marks a pivotal milestone in our electrification journey. It will streamline our operations and ensure efficient resource allocation. Our long-term vision for sustainable growth and leadership in the electrification ecosystem starts now. Under Latour Capital’s expert guidance, Lynxeo’s future will shine brightly. Their wealth of experience and strategic insight will undoubtedly catalyze Lynxeo’s growth and innovation.

Chief Executive Officer, Nexans

Lynxeo is a unique opportunity in the specialty industrial cables, ideally positioned in a highly fragmented and growing market. We firmly believe in Lynxeo’s strong growth potential and are pleased to embark on this exciting journey.

Senior Partner and Partner, Latour Capital

The relevant works council will be informed and consulted in connection with the proposed transaction. In addition, the proposed transaction remains subject to the fulfilment of customary regulatory approvals. On this basis, the closing of the proposed transaction could take place in the second half of 2025.

J.P. Morgan Securities Plc is acting as exclusive financial advisor to Nexans while Bredin Prat is acting as legal counsel on the transaction.

All our press releases

Read allIn response to recent media reports regarding the Great Sea Interconnector project, Nexans communicates that these claims do not reflect the actual status of the project or the ongoing relations with the customer.

Nexans have, since the commencement of the Great Sea Interconnector project, received substantial payments that have enabled the continued manufacture of the Great Sea Interconnector cable.

Nexans intends to continue to execute the Great Sea Interconnector project contractual obligations and receiving the corresponding payments in accordance with the contract and the most recent discussions with the customer.

We reaffirm our dedication to the successful completion of this strategic infrastructure project, which is essential for regional energy security and the integration of sustainable energy sources.