Nexans announces today having entered into exclusive negotiations with Samvardhana Motherson International Limited (“Motherson”), a leading global supplier of automotive systems and components, for the sale of Nexans’ wiring harness business Autoelectric for an Entreprise Value of € 207 million.

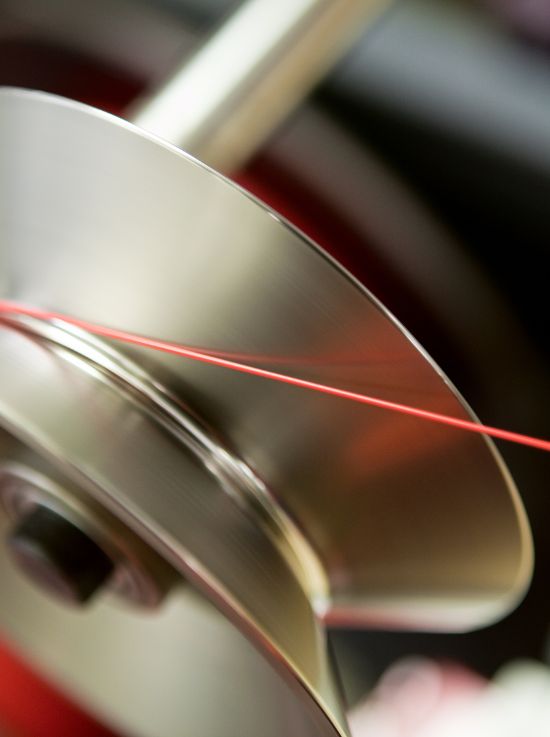

Autoelectric, headquartered in Floss, Germany, designs and manufactures wiring harness and vehicle wiring system solutions for the automotive industry. The business generated c.€749 million current annual sales in 2024 with nearly 14,000 employees. This divestment marks the completion of Nexans’ strategic transformation into a pure electrification player.

Since 2023, Nexans has successfully divested its non-electrification activities, including Aginode, AmerCable and Lynxeo to focus fully on its ‘Sparking Electrification’ strategy. As the last remaining non-electrification business in our portfolio, the time has come for Autoelectric to continue its development under a new owner that is deeply anchored in the automotive industry. Motherson represents a natural strategic fit and provides the right environment for the business to continue growing. With this transaction, Nexans fully deploys its model of value creation of pure player in electrification, serving clients at the heart of the global energy transition and enabling the development of low-carbon, sustainable power systems that meet the world’s accelerating demand for electrification.

CEO, Nexans

This acquisition is a significant milestone for Motherson. It will enable us to support our key customers with wiring harness solutions and expand our global footprint to additional locations. We believe that our executional capabilities combined with AutoElectric’s strong engineering capabilities and customer relationships, will drive innovation and sustainable growth. We look forward to welcoming all new members of AutoElectric into the Motherson family.

Chairman, Motherson Group

The relevant works council will be informed and consulted in connection with the proposed transaction, which would be structured as a series of sales of shares and assets to acquire the harness business of Autoelectric. In addition, the proposed transaction remains subject to the fulfilment of customary regulatory approvals. On this basis, completion of the proposed transaction could take place mid-2026. The terms of the transaction are not disclosed. Evercore is acting as exclusive financial advisor and Linklaters as legal counsel to Nexans in connection with this transaction.

IFRS 5 – Accounting treatment and resulting implications for 2025 outlook

In accordance with IFRS 5, the proposed transaction will trigger the classification of Autoelectric, as Assets Held for Sale in the 2025 consolidated financial statements.

As a result, the Industry and Solutions Businesses (consisting of Amercable, Lynxeo and Autoelectric) will be classified as discontinued operations in the 2025 consolidated financial statements. Such classification will be reflected on both the year 2025 and the comparative year 2024, in order to ensure the consistency of presentation between reported periods.

The 2025 guidance, as updated on July 30th 2025, forecasted Autoelectric as a consolidated segment for 2025, while Lynxeo was consolidated for the first half of 2025, until the day of completion of the disposal on June 30th 2025.

As a consequence, the 2025 guidance is today being aligned with the new scope of continuing operations, the new scope which now excludes the discontinued operations (within the meaning of IFRS 5).

Under this new scope, the 2025 guidance, as updated on 30th July 2025, remains otherwise unchanged:

| Adjusted EBITDA | Low range (M€) | High range (M€) |

| 2025 Guidance (presented in July 2025) (included 12 months of Autoelectric and 6 months of Lynxeo) |

810 | 860 |

| Exclusion of discontinued operations (12 months of Autoelectric and 6 months of Lynxeo) |

100 | 100 |

| 2025 Guidance aligned with new scope | 710 | 760 |

| FCF | Low range (M€) | High range (M€) |

| 2025 Guidance (presented in July 2025) (included 12 months of Autoelectric and 6 months of Lynxeo) |

275 | 375 |

| Exclusion of discontinued operations (12 months of Autoelectric and 6 months of Lynxeo) |

– | – |

| 2025 Guidance aligned with new scope | 275 | 375 |

The remaining details of the proposed transaction will be outlined in the Nexans 2025 consolidated financial statements.

Nexans confirms its 2028 guidance which remains unchanged.