News & Media Room

Find all our news, press releases and upcoming events.

Press releases

7-year contract secured with Enedis in France

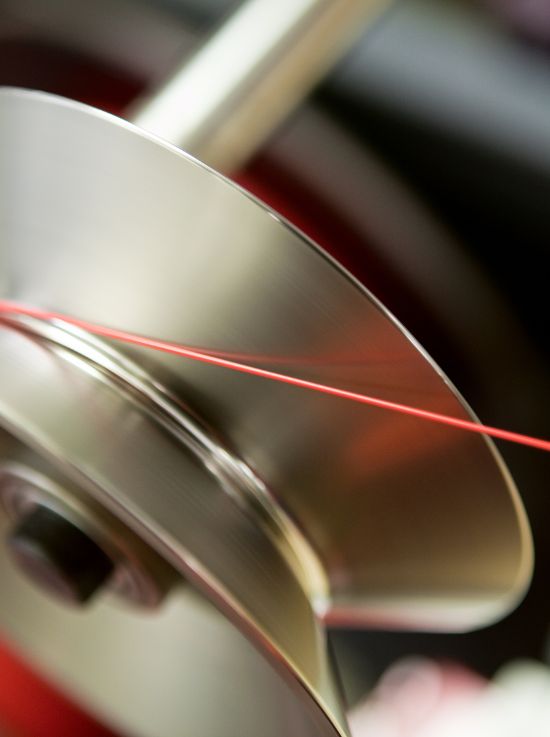

Nexans stood out with a proposal that was carefully designed and aligned with Enedis’ priorities: economic performance, security of supply, and CSR commitment (environmental impact). The cables will mainly be manufactured in France at the Bourg-en-Bresse site, with production capacity secured by a second site in Italy. These capacities are supported by major industrial investments to boost the production of low-carbon medium-voltage cables.