With the global demand for electricity expected to increase 20% by 2030 and the increasing pressure to transition to renewables, the War of the Currents is once again in the spotlight.

Back in the 1880’s, when Westinghouse and Edison were battling for their respective approach to electricity distribution, the infrastructure to transmit direct current (DC) power was at the time inefficient and expensive. And as such, Nikola Tesla’s approach using alternating current (AC) ultimately won. And since that time, our current electrical infrastructure is dominated by AC technology. But times have changed since then.

Today, over 70% of devices in a building need DC to operate. A conversion from AC to DC results in energy wastage of upwards to 20%, according to EMerge Alliance. Reducing the need to convert has profound implications regarding energy savings and environmental impact. And this is why eliminating or reducing AC to DC conversion in buildings is critical.

The International Energy Agency reports that in 2021 the operation of buildings accounted for 30% of global final energy consumption and 27% of total energy sector emissions. As a result, governments are placing increasing pressure on the building sector to move towards ambitious energy performance directives to reduce the carbon footprint of buildings. Directives such as “nearly zero-energy buildings” in the U.S. and in Europe aim for buildings to require a low amount of energy provided by renewables produced on-site or nearby.

Directives like these, along with the growing usage of self-consumption, onsite battery storage and DC-powered devices from LED lighting and heating, ventilation and air-conditioning (HVAC) systems to electric vehicles (EV) and electronic devices, are driving the building industry to switch to DC power distribution.

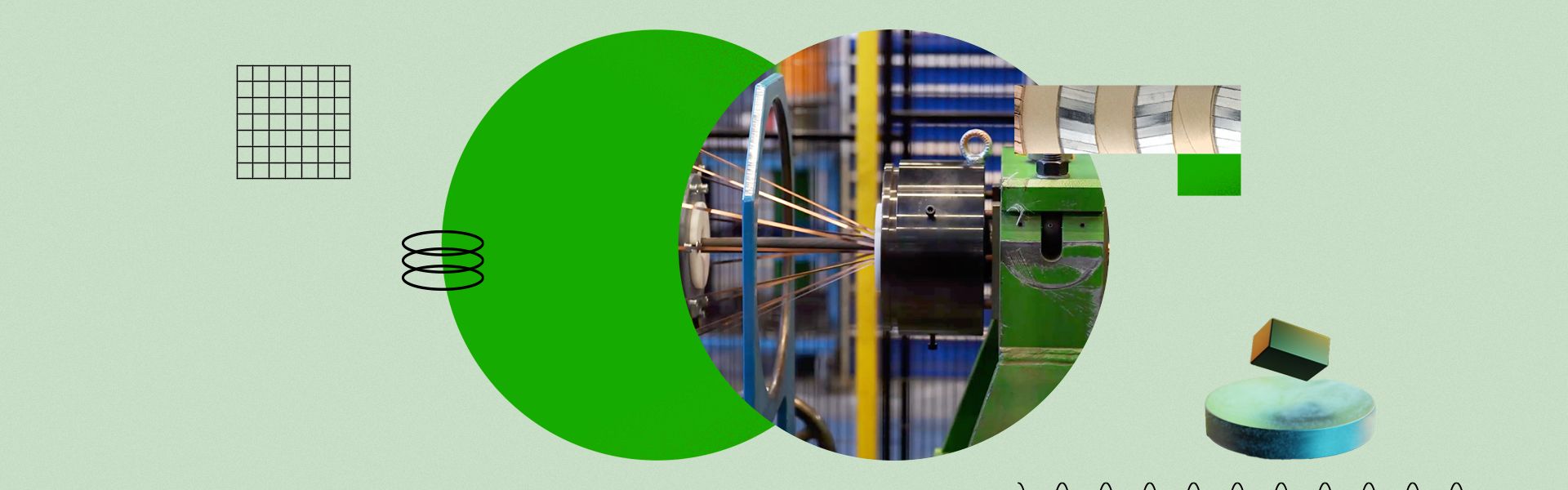

The move towards to reliable DC cable systems for DC microgrid

In terms of electric power distribution, there is a progressive shift towards DC due to the growing interest in low voltage (LV) and medium voltage (MV) microgrids reflecting the fundamental changes in how electricity is generated, stored, and consumed. We are convinced that AC and DC networks will coexist with a significant share.

However, expert knowledge of the behavior of the insulation system is vital to ensuring the reliability of LV cables and accessories in buildings.

The behavior of LVAC cable systems is largely known but not for LVDC.

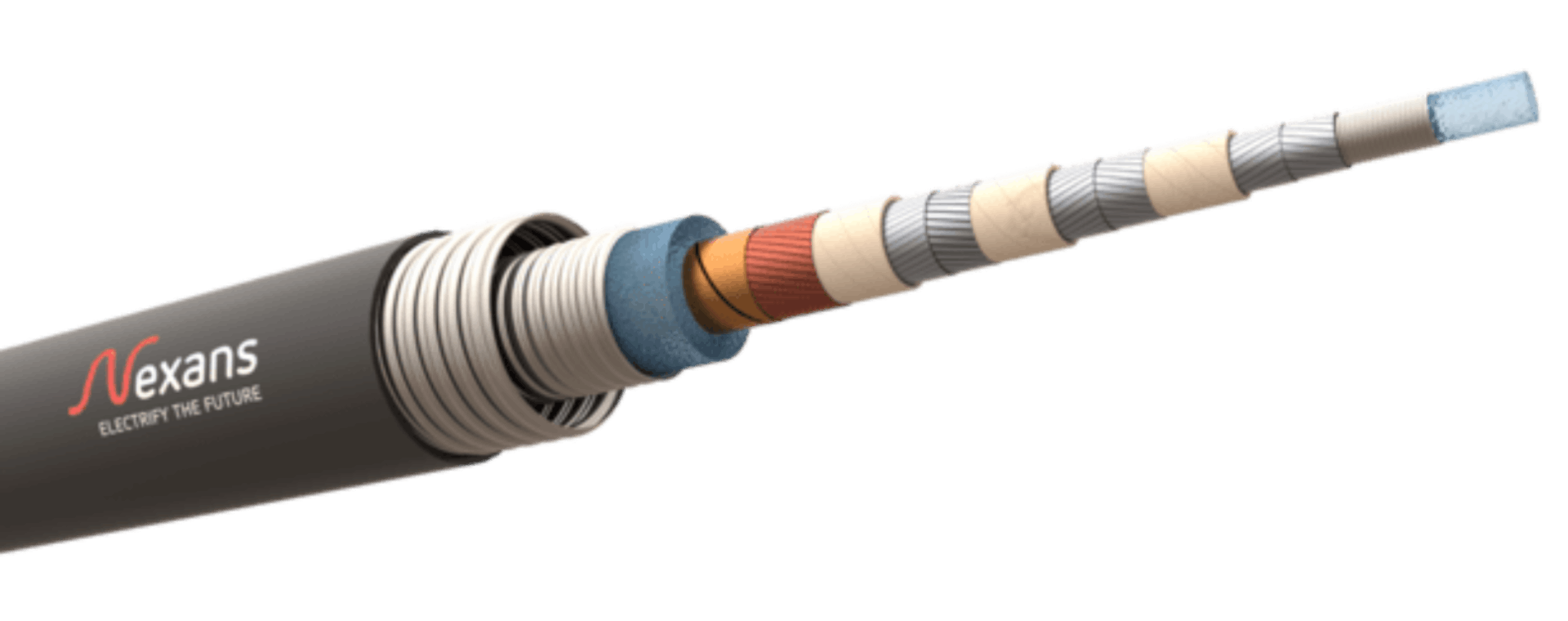

One of the focuses of Nexans’ R&D center AmpaCity is to optimize our cable design: we perform this optimization, which is achieved by understanding the electrical behavior of insulation systems under DC stress conditions and the impact of DC current on cable breakdown, ageing and corrosion. We’re also committed to investigate on more effective polymers for DC cable insulation with lower environmental impact than AC classical solution.

DC building transformation is a Fact

As mentioned earlier, power generation is moving closer to demand. Rooftop solar photovoltaics are becoming more commonplace. According to the EU Solar Energy Strategy, EU will make compulsory the installation of rooftop solar in new public and commercial and residential buildings. Furthermore, PV panels produce natively DC. In addition to the widespread implementation of on-site battery storage for uninterrupted power supplies (UPSs) used by businesses and data centers to maintain supply security, along with the growing deployment of battery energy storage systems (BESSs) for grid balancing.

Another major change in recent years is the growth of electric vehicles (EVs) and the need for DC charging stations in commercial, residential, and office buildings. With global policies encouraging and mandating the move to EVs, the market for chargers is growing rapidly, at an estimated compound annual growth rate (CAGR) of 29% from 2023 to 2050.

Local DC-power distribution

Distributing DC power locally throughout a building provides important benefits in safety, costs, and device reliability.

From a safety point of view, AC power is inherently more dangerous. In fact, the risk of electrocution of the human body by DC is considered to be lower than with AC, as the total impedance of the human body decreases as the frequency increases. And for high growth categories such as EV chargers, the move to DC versus AC chargers means better overall safety.

The data center sector accounts for around 4% of global electricity consumption, and is set to continue growing. Improving energy efficiency in this sector is crucial. For example, cost savings in electricity-intensive buildings such as DC-powered data centers can represent savings of 4-6% compared to conventional AC installations.

In addition to the reduction in electrical losses linked to the transport of electricity in cables, there is also the reduction in AC-DC conversion losses.

Providing DC devices (loads) with DC power eliminates power losses incurred through conversion and thus eliminates an estimated 5 to 20% in energy waste. In addition, the AC to DC conversion process at the device level can shorten its operating life. For example, distributing DC power directly to a LED fixture (thus avoiding the AC to DC conversion) can substantially extend its operating life. Plus, distributing DC power locally reduces the cost and footprint of AC to DC adapters and converters.

Transition to DC-powered buildings

In conclusion, DC power distribution in buildings is on the horizon, but change will take time. Even with a move to DC microgrids, there are other significant challenges to be addressed in the coming years, notably the uptake by industry professionals, many of whom need to become more familiar with DC power and its benefits. This is due to the long experience and knowledge of AC power.

Furthermore, advancement in building standards and codes which address specifications for DC-powered devices is required, as with the further analysis of the cost-effectiveness of DC power distribution in retrofit and new construction.

Cables are a fundamental part of a building’s electrical infrastructure and are a critical player in the transition to DC-powered structures. The buildings of tomorrow will be smart, connected, sustainable, and powered by DC. Nexans is committed to this transformation by manufacturing specific cable systems compatible with these new infrastructures. And our strategic partnerships and involvement in key industry groups are helping to make the transition to DC-powered buildings a reality.